How do I do my Tax Settings?

To Set Up Tax Rules

Tax rules are defined as a combination of a customer tax class and a product tax class with a tax rate. In other words, based on the class of the customer (customer tax class), the class of the products (product tax class) in the shopping cart, and the region (tax rate depending on the shipping address, billing address, or shipping origin), Magento calculates the appropriate tax for each order.

To add a new tax rule:

From the Admin panel, Select Sales > Tax > Manage Tax Rules.

In the Manage Tax Rules are, click the Add New button to add a new tax rule.

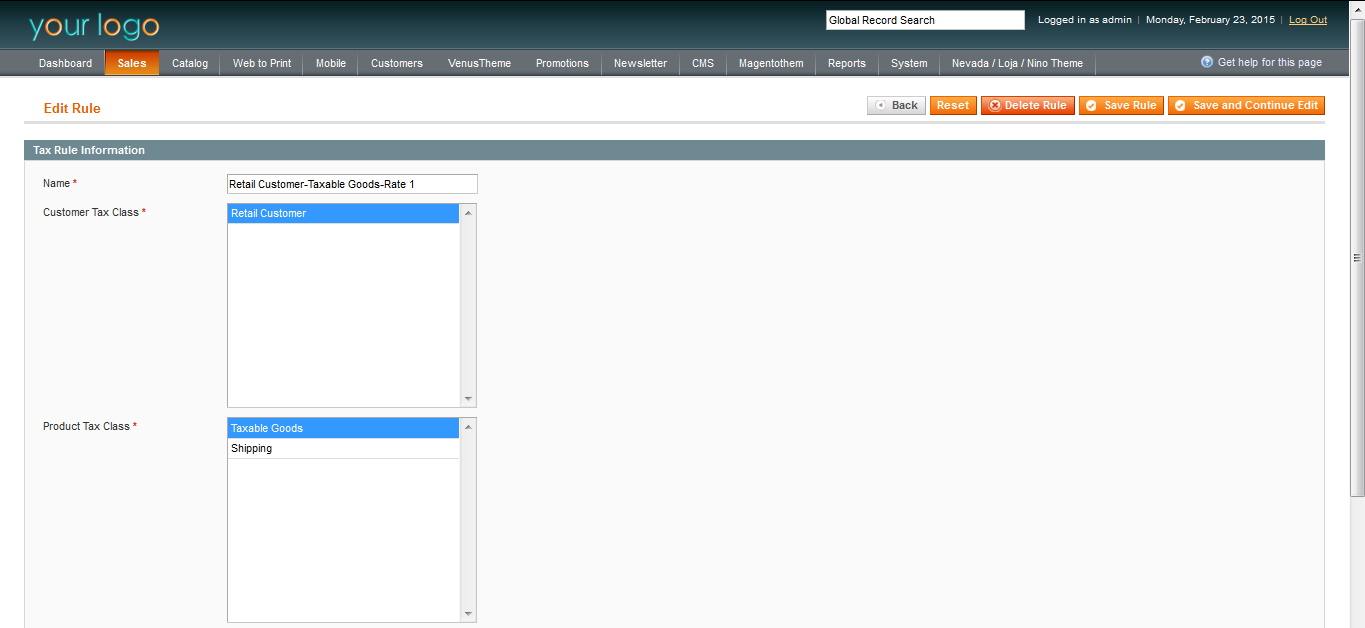

The Edit Rule page is displayed, as shown in the above figure.

-

In the Tax Rule Information area, select the options as shown in the following table.

Name: Specify a name for this tax rule that will make it easy to identify.

Customer Tax Class: Select the customer tax class to which you will apply this tax rule.

Product Tax Class: Select the product tax class to which you will apply this tax rule.

Tax Rate: Select the tax rate to apply for this tax rule.

Priority: Specify the priority of this tax, when more than one tax applies. Lower numbers have higher priority. If two tax rules with the same priority apply then the taxes are added together. If two taxes with a different priority apply then the taxes are compounded. When taxes are compounded, the first priority tax is calculated on the subtotal amount, andthen the second priority tax is calculated on the subtotal plus the first priority tax amount.

Calculate off subtotal only: Important Check this checkbox to override priority order for compounding taxes.In other words, for this tax rule, tax will be calculated only on the subtotal.If you clear this checkbox, the regular compounding tax calculation is used.

Sort Order: Specify the order in which tax rules are displayed on the Manage Tax Rules page.Lower numbers have higher sort order in the list.

Click the Save Rule button to save your changes.

Magento uses both customer tax classes and product tax classes to determine the rules which are used as the basis of tax calculations.

Tax rules are a combination of customer tax class, product tax class, and tax rates. Each customer is assigned to a customer group, which in turn is associated with a specific tax class. Products are also assigned a tax class when each record is created. Magento determines the tax by analyzing the tax class of the products in the shopping cart, the tax class of the customer, and the region where the transaction takes place.

Add a New Customer Tax Class and Apply It to Customers

Customer tax classes define which types of taxes are applied orders placed by customers that you have assigned to customer groups. You create customer tax classes and assign customers to them depending on the type of customer. For example, in some jurisdictions, wholesale transactions are not taxed but retail transactions are.

To add a new customer tax class:

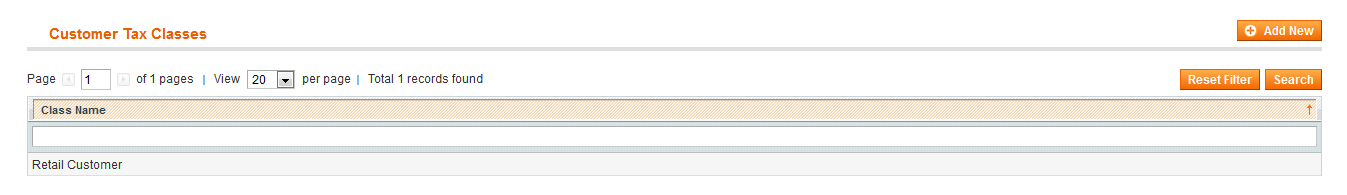

From the Admin panel, select Sales > Tax > Customer Tax Classes.You see the list of existing customer tax class names, as shown in the above figure.

To add a new customer tax class, click the Add New button in the upper right.

In the Class Name box, type the name for your new customer tax class. For this example, use “Retail Customer” for the class name.

Click Save Class.

You can now see the Retail Customer class displayed. Apply the Retail Customer class to a customer group from your store by going to Customers > Customer Groups. Select the newly created tax class called Retail Customer and click save.

Apply the Customer Group to a customer in your store by going to Customers > Manage Customers. Select a customer from your store and in the Group column, click the dropdown to select the customer group that is associated with the appropriate customer tax class for this customer

Click Save.

Add a New Product Tax Class and Apply It to Products

Product tax classes define which types of taxes are applied to orders containing products that you have assigned to product groups. You create tax classes and assign products to them depending on the type of product. For example, food might not be taxed, or might be taxed at a different rate.

To add a new product tax class:

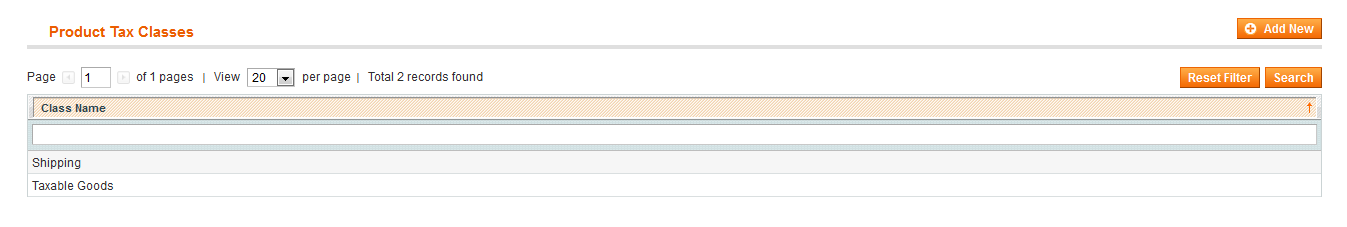

From the Admin panel, select Sales > Tax > Product Tax Classes.You see the list of existing product tax class names, as shown in the above figure.

To add a new product tax class, click the Add New button in the upper right.

In the Class Name box, type the name for your new product tax class. For this example, use “Taxable Goods” for the class name.

Click Save Class.

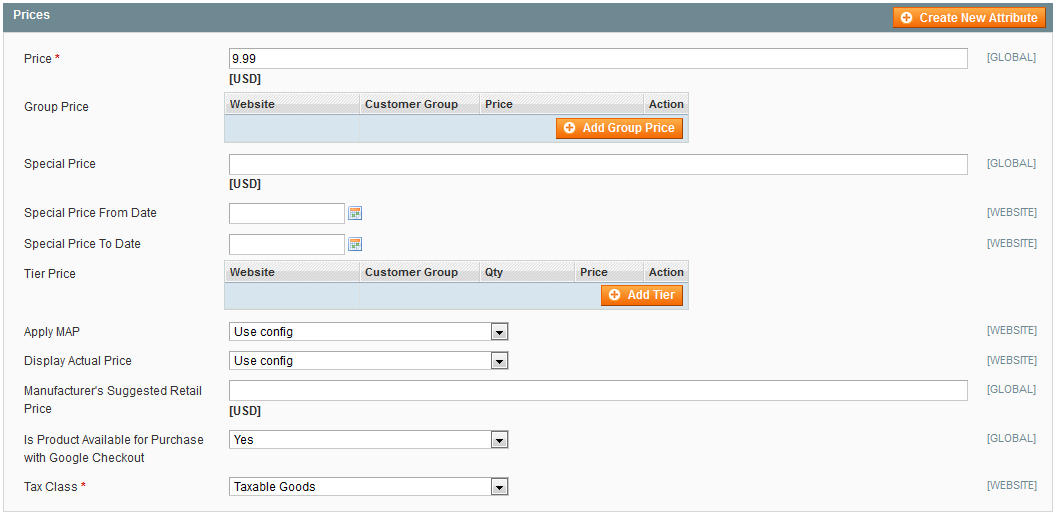

Apply the Taxable Goods class to an actual product from your catalog by going to Catalog >Manage Products. Select a product from your catalog to see options like the ones shown in the following example, on the General tab.

Select the tax class called Taxable Goods and click Save